Excitement About Fortitude Financial Group

Excitement About Fortitude Financial Group

Blog Article

Getting The Fortitude Financial Group To Work

Table of ContentsFacts About Fortitude Financial Group RevealedThe Greatest Guide To Fortitude Financial GroupThe Definitive Guide for Fortitude Financial GroupAbout Fortitude Financial GroupFortitude Financial Group Fundamentals Explained

Keep in mind that lots of experts won't handle your properties unless you meet their minimum requirements (Financial Resources in St. Petersburg). This number can be as low as $25,000, or reach into the millions for the most unique experts. When selecting an economic expert, figure out if the private complies with the fiduciary or suitability criterion. As noted earlier, the SEC holds all advisors signed up with the firm to a fiduciary criterion.If you're looking for monetary recommendations but can not manage a financial expert, you could think about employing a digital investment advisor called a robo-advisor. The wide area of robos spans platforms with access to monetary advisors and financial investment monitoring. Empower and Improvement are two such instances. If you're comfy with an all-digital platform, Wealthfront is another robo-advisor alternative.

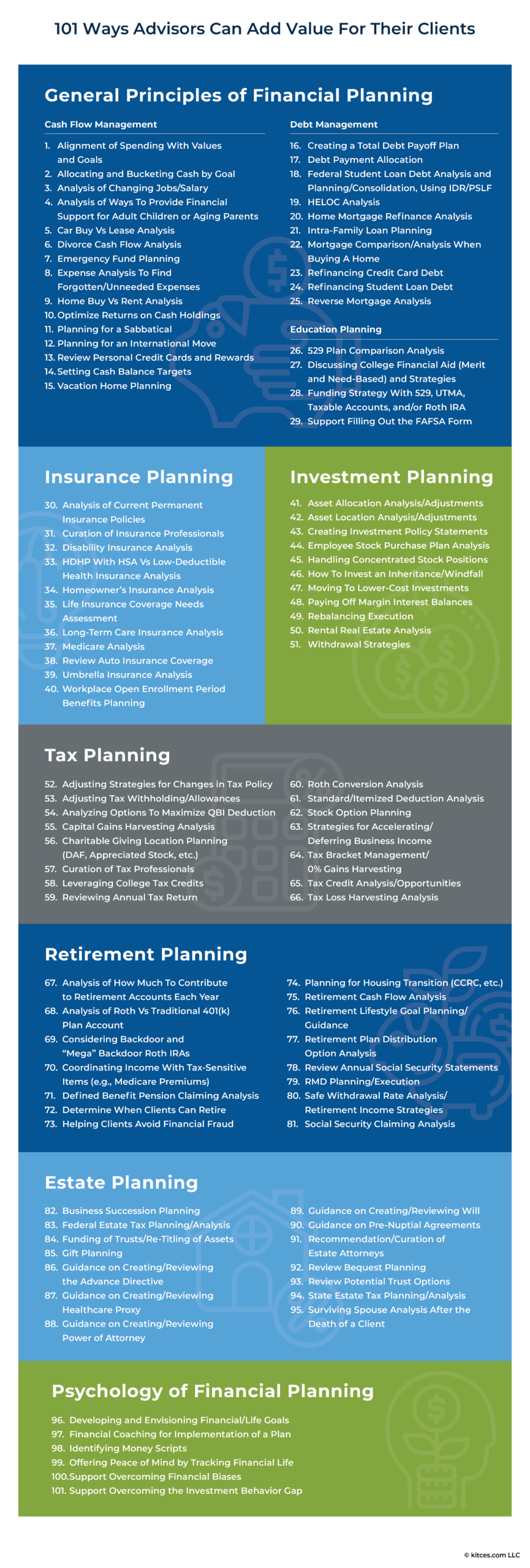

You can discover an economic consultant to aid with any type of facet of your monetary life. Financial consultants might run their very own firm or they might be part of a larger workplace or financial institution. No matter, a consultant can assist you with whatever from developing a financial strategy to investing your money.

Fortitude Financial Group Fundamentals Explained

Inspect that their credentials and abilities match the solutions you want out of your expert. Do you desire to discover more regarding economic advisors?, that covers principles surrounding accuracy, credibility, content freedom, competence and neutrality.

Most individuals have some emotional link to their money or the important things they get with it. This emotional link can be a key reason why we might make poor monetary choices. An expert economic advisor takes the feeling out of the formula by giving objective guidance based upon understanding and training.

As you go through life, there are monetary choices you will make that could be made extra easily with the advice of a specialist. Whether you are attempting to reduce your financial obligation lots or wish to start preparing for some long-lasting goals, you might profit from the solutions of a monetary advisor.

What Does Fortitude Financial Group Do?

The basics of financial investment monitoring consist of purchasing and offering financial assets and other financial investments, but it is more. Handling your financial investments includes comprehending your short- and long-lasting goals and making use of that details to make thoughtful investing choices. A monetary advisor can provide the data required to aid you diversify your investment portfolio to match your wanted degree of danger and satisfy your economic objectives.

Budgeting provides you a guide to just how much cash you can invest and just how much you should save every month. Complying with a budget will help you reach your brief- and lasting financial objectives. A monetary expert can aid you detail the activity steps to take to establish and keep a budget plan that helps you.

In some cases a clinical expense or home repair work can suddenly add to your financial obligation tons. A professional financial debt management strategy helps you pay off that financial debt in the most economically useful means feasible. A monetary consultant can aid you assess your debt, prioritize a debt payment strategy, supply options for financial debt restructuring, and lay out a holistic plan to far better manage debt and meet your future economic goals.

The Main Principles Of Fortitude Financial Group

Personal money flow evaluation can inform you when you can manage to acquire a brand-new automobile or exactly how much cash you can contribute to your financial savings each month without running short for necessary expenses (Financial Services in St. Petersburg, FL). A financial advisor can help you plainly see where you invest your cash and after that apply that insight to help you understand your financial wellness and exactly how to boost it

Danger monitoring solutions recognize potential risks to your home, your lorry, and your household, and they assist you place the best insurance policies in place pop over to this web-site to minimize those dangers. A monetary advisor can assist you create an approach to safeguard your earning power and lower losses when unforeseen things occur.

5 Easy Facts About Fortitude Financial Group Described

Reducing your taxes leaves more money to add to your investments. Financial Advisor in St. Petersburg. An economic consultant can assist you use philanthropic offering and investment methods to minimize the quantity you have to pay in tax obligations, and they can show you just how to withdraw your money in retired life in such a way that likewise minimizes your tax worry

Even if you didn't start early, university planning can help you place your child via university without encountering unexpectedly huge expenditures. An economic advisor can assist you in recognizing the most effective means to conserve for future college prices and how to fund possible voids, discuss exactly how to reduce out-of-pocket college expenses, and suggest you on eligibility for monetary help and grants.

Report this page